A Comprehensive Payroll Implementation Guide for SMBs

Index

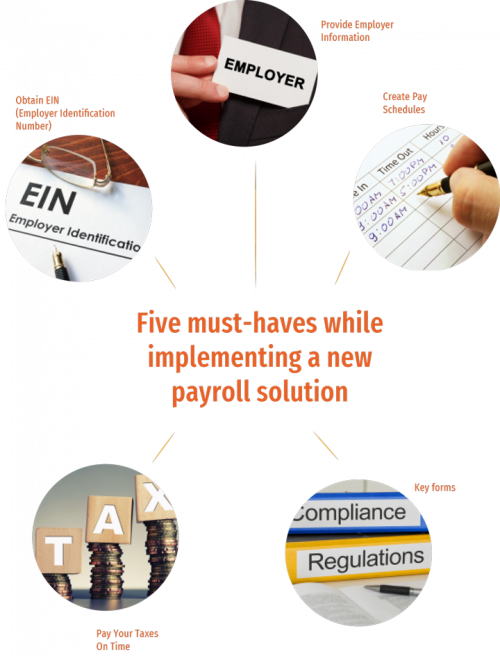

- Five must-haves while implementing a new payroll solution!

- What Type of Payroll Management Options Are Available?

- How to Choose Your Payroll Software?

- Why You Need to Invest in Payroll Technology & the Advantages?

INTRODUCTION

When you’re just starting to implement a payroll for your small business, it can be easy to make mistakes.

Unfortunately, small oversights in the business world can be a huge blunder resulting in hefty fines!

An easy way to avoid these errors is by using a payroll software solution to handle all your payroll tasks.

Most payroll solution providers such as UZIO help you in the overall setup and implementation of the software. However, if you’d rather want to implement it yourself then you must be aware of all the required paperwork you’ll need, as well as the procedures you must follow before attempting to implement a payroll solution in your company.

Lucky for you, we’ve gathered a list of things you’ll need to keep in mind to avoid being fined, stay compliant with federal regulations, and successfully implement a payroll solution into your small business.

Read on to learn about the five must-haves while implementing a new payroll solution!

01. Obtain EIN(Employer Identification Number)

Every business operating legally within the United States is required by the IRS (Internal Revenue Service) to be assigned an EIN.

This number allows the IRS to easily identify your business for tax purposes. However, it’s quite easy to apply for an EIN and you can do the process for free!

The easiest way being online (which you can do by clicking here). To apply for an EIN, you will need a valid Taxpayer Identification Number (you can use your Social Security Number, Individual Taxpayer Identification Number, or a pre-existing EIN).

If you don’t like doing things online, you can also apply for an EIN by fax or mail using Form SS-4. For business owners located outside of the US, the IRS has a phone number you can call to be assigned your EIN.

Recommended reading: How to Apply for an EIN (IRS Official Website)

Having an EIN for your business is important for reasons beyond the simple IRS requirement.

Without an EIN, you won’t be able to open a business bank account, which means that your business accounts and personal accounts will be the same (which opens them up to access in the event of a debt collector or lawsuit). You will also need an EIN to hire any employees, or (if you’re self-employed) to set up a 401(k) plan.

02. Provide Employer Information

Employer Information forms are a vital part of your business if you plan on employing foreign workers.

To hire a foreign worker, you will first need to determine if they are going to be a temporary worker or a permanent employee. Depending on which type of worker they are, you will either have to:

A.) file a nonimmigrant petition, or

B.) assist them in obtaining a green card.

If you choose not to follow these requirements, not only will you be losing the benefits of E-Verify but you also risk your workers being deported.

03. Create Pay Schedules

Pay schedules are used to determine how often you pay your employees for the hours worked in that specific pay period.

Although there are some requirements (which vary by state), beyond that you will have the general freedom to set your employee’s pay schedules.

Recommended reading: State Payday Requirements– Table of State Payday Requirements (An official website of the United States government)

While the simplest option is to have all employees on the same pay schedule, you can also create separate pay schedules for different departments if you wish.

Creating these pay schedules manually is time-consuming, so you may want to consider investing in payroll software to save yourself some time (and prevent mistakes!).

Recommended reading: Biggest pain point with Payroll and HR software

You have a few different options when it comes to creating your payment schedules.

The most common choices are weekly and bi-weekly pay schedules.

Monthly is another option (although less common). You can also choose to pay employees semi-monthly.

With this type of pay schedule, employees will get paid on the same days of the month each month. Regardless of which payment schedule you choose to use, it’s important to explain both the pay periods and the pay schedules to your employees.

If they don’t understand why they’re being paid so much (or so little), they are more likely to walk away from your company. Don’t let a simple miscommunication ruin your retainment records! We highly recommend reviewing pay periods and schedules with all employees, not just the new ones.

04. Pay Your Taxes On Time

All businesses (even those who are self-employed) are required to pay taxes to the IRS. Your annual taxes must be filed at the end of the year when you file your annual income tax return (unless you’re a partnership, in which case you would file an information return).

Recommended reading: Business Taxes (small businesses/self-employed) (An official website of the United States Government)

However, your business may also be required to make estimated tax payments throughout the year.

If you don’t pay these on time, then the IRS may apply late fees and interest to your amount owed. The frequency of payments you are required to make depends on the size of your business, but you will always need to make at least quarterly estimated tax payments to the IRS.

If you choose to use a Payroll platform (like UZIO) then the software will let you know when your payments are due, but if not, then you will have to figure out these payment dates for yourself.

Recommended reading: Estimated Taxes for small businesses and self employed (An official website of the United States Government)

In addition to the taxes your business owes, you must also keep track of the taxes your employees owe. As the employer, you are responsible for withholding federal, state, and local taxes from your employee’s paychecks. These taxes may include (but are not limited to):

- Federal Income Tax

- Social Security Tax (FICA)

- Medicare Tax (FICA)

Recommended reading: What are payroll taxes and why do small business owners must know about them?

Taxes owed to the state or locality will vary by location, so be sure to look into these requirements as well to ensure you’re withholding all relevant taxes.

05. Keep These Key forms Handy

As you can see, starting a payroll isn’t a simple process. There are many forms and other types of documentation you will need to keep on file if you choose to do this process manually.

Recommended reading: How to manage payroll when you are just starting out

Fortunately, utilizing payroll software for small businesses can help keep the clutter out of your office, and will also ensure you remain compliant with the ever-changing rules and regulations regarding your payroll.

However, if you decide to forgo using small business payroll software and instead do it all yourself, here are a few of the forms you’ll want to have handy at all times.

- Form W-2 – This form reports withheld employee wages.

- Form W-3 – This form provides a summary of your W-2 information.

- Form 940 – This form reports your Federal Unemployment Tax Act (FUTA) liability.

- Form 941 – This quarterly form reports employee wages and payroll taxes.

- Form 944 – This form reports annual employee wages and payroll taxes.

- Form 1094-B – This form is used to record employee health coverage.

Recommended reading: A Guide to Essential Payroll Forms & More for Small Business Owners

What Type of Payroll Management Options Are Available?

When it comes to managing your payroll, you’ll have a choice between a traditional, done-by-hand approach or the more modern, electronic route of using dedicated payroll software for small businesses

Each option presents its own set of potential issues, but they both have a few advantages as well. Let’s take a quick look to compare the pros and cons of each option.

Manual Payroll Processing

This approach requires manually tracking employee hours, calculating applicable taxes, and distributing paychecks (or direct deposits) yourself

PROS:

- Low starting costs since you only need a computer with Excel (or other similar software). If you prefer to do things entirely by hand, you can also payroll record book.

- Readily available and requiring no additional purchases, a manual payroll approach can be implemented easily at any time.

- Potentially low ongoing costs are also a benefit. You won’t need to pay an outside company or contractor to handle your payroll.

CONS:

- Hard to scale and easily falling behind, manual payroll processes will steadily perform worse as your company grows.

- Prone to errors, a system handled entirely by individuals can result in thousands of dollars worth of penalties from even the smallest mistake.

- Time-consuming manual payroll processes will only compound as your business expands.

Automatic Payroll Processing

This approach uses cloud-based payroll software to automate employee hour tracking, tax calculations, and paycheck (or direct deposit) distributions.

PROS:

- Easily scalable since all calculations and processes are handled by an automated payroll program.

- The least errors occur when using an electronic payroll process because most payroll software checks for compliance issues while automatically calculating your payroll.

- Faster payroll processing times, thanks to an automated system that accurately calculates employee paychecks in real-time.

- No third-party services are required to charge you for every transaction, you can all do it yourself with a few easy clicks. This saves you a lot of money.

- No software installation is required and can easily be accessed using your browser.

CONS:

- Requires initial training to get acquainted with the process.

- Employees must be trained to get familiar with the self-service platform that will require employees to stop bothering the employer for stuff like paystubs, basic know-how about their payroll, etc.

Manual payroll services may work for extremely small businesses, probably up to 5 to 8 employees, but if you’re planning on growing your company beyond a few employees, we strongly recommend you consider implementing electronic, complete payroll solutions.

How to Choose Your Payroll Software?

If your business is expanding and you’ve decided to implement payroll software, you must take an educated approach to your new venture.

Not doing so may be costly for your business, ineffective at addressing issues, and create more problems than it solves.

Here’s a step-by-step guide you can follow to ensure you pick the payroll software that’s right for your business.

01. Defining Your Needs

Before you start considering specific payroll services it’s important to define your expectations. If a payroll platform can’t meet all of your basic needs then you can instantly cross it off the list. Here are some common basic needs.

- Time Tracking: Being able to keep track of your employees’ time and attendance is a key feature of any payroll software. Make sure your choice of the platform includes this.

- Tax Calculations Efficiency is the key to success, so automated tax calculations are a must-have in any reputable payroll platform.

- Payroll Reporting :These detailed reports are something you won’t want to miss. The valuable details contained within can give important insights regarding the financial flow of your business.

- Security: When Social Security numbers are in question, you need to be able to trust your payroll software provider to keep this information secure.

02. Considering Your Wants

- Integrated Platform: As the business grows, you will need to ensure you are not juggling from one app to another to manage your employees. Therefore you will need a system that has solutions for your future needs and assure the information provided or changes made anywhere is reflected across the entire system. This approach is not only going to save you from future hassles but also centralize your HR process & operations.

- Flexible Pay Options: While a weekly, bi-weekly, or monthly payment schedule may work for some businesses, eventually some employees will want a different pay schedule. Fortunately, complete payroll solutions often offer various pay schedules within their platform. Just make sure it’s not a paid add-on!

- Direct Deposits: Employers should be able to directly deposit the payments to their employees’ or contractors’ bank accounts. This saves a lot of time and creates a healthy environment within the organization.

- Compliance: Your payroll software must be compliant with the local federal laws and regulations. Staying compliant is essential for an effective payroll management system.

- Automatic Salary Changes: Your system must be smart enough to ensure any changes reflected in one place to be communicated across the platform in real-time. An otherwise situation may result in disasters for employers in the long run.

- Automatic Tax Filing: You will want all your taxes to be filed on your behalf to the right federal tax authorities on time. This is a very crucial feature which not many have but the prominent players in the industry.

03. Analyzing the Implementation Process

How easy will it be to implement your new payroll software? You should lean towards platforms that won’t cause any disruption to your current payment schedule and can be fully implemented fairly quickly. The last thing you want is for your company payroll to be split between the old system and the new one!

04. Calculating the Price

Upfront costs are an important consideration, but the focus should be on the cost of ongoing service.

If your payroll platform offers discounts for new customers, what will the cost be after the promotional period?

Remember, high initial costs with low ongoing costs are much better than low initial costs with high ongoing costs, so make sure to research all potential pricing issues before making your decision.

After you’ve considered all available options and settled on a few, it’s time to ask your team for input. You may have to explain the benefits of the new system to them, so be prepared to answer any questions they may have.

If they have concerns, take them into account. At the end of the day, you’re the one deciding how they get the paychecks they rely on, so you should be willing to meet them in the middle, basing the final decision on employee input and your system analysis.

Why You Need to Invest in Payroll Technology & the Advantages?

Utilizing payroll software offers a clear advantage over using manual processes to handle your payroll. That said, while automation is certainly helpful, you might find yourself wondering if payroll software is truly a need, rather than just something you want.

To help you decide this answer for yourself, here are our top reasons why we think having payroll technology is a necessity for running a successful business.

- They can help prevent legal fees. Most payroll software for small businesses reviews your documents to ensure your payroll remains compliant with federal, state, and local tax laws. If you manage your payroll manually, it can be hard to stay compliant with these ever-changing regulations. Unfortunately, you will be held responsible for compliance regardless of how you manage your payroll, so even the smallest of manual errors could result in large fines for your company. By using small business payroll software, you can avoid any potential fines because the program will ensure your payroll remains compliant.

- They save you time. One of the biggest benefits of using complete payroll solutions is automation. With an automated system, payroll processes that previously took hours of staff time can be completed in an instant using your choice of payroll software. This allows your staff to manage their time more effectively since they’ll no longer have to manually process your payroll and can instead focus on other priority tasks at hand.

- They guarantee accuracy. When you’re manually calculating the payroll, it can be easy to get caught up in the repetition and accidentally miss something. Whether it’s a simple miscalculation or omitting an entire process, these mistakes will mess up your entire payroll process, leaving employees with inaccurate paychecks. Your staff is unlikely to take this information well, so in addition to dealing with unhappy employees, you’ll also have to go back and recalculate your entire payroll to ensure all the information is correct. Having a payroll platform in place provides peace of mind because you’ll never have to worry about these types of mishaps hindering your business.

- They give employees easy access via self-service. If you don’t have any payroll services in place, your employees will rely on HR and payroll staff to answer any questions they may have regarding their paychecks. They will also need to visit HR/payroll if they want to make any changes to their information on file—such as updating an address—or to request time off. Having a complete payroll solution in place will allow employees to tend to these issues themselves using an online portal, rather than relying on the HR staff to handle them. Your HR staff is sure to thank you, as they’ll spend less time addressing employee concerns and have more time to manage other essential tasks.

- They allow you to manage documents easier. Managing documentation and forms can pose a huge challenge if your current process relies on paper records. Unlike traditional methods which require you to sift through piles of paperwork to find the information you need, small business payroll software makes it easy to access this information with just a few clicks! Having information essentially available “as needed” makes updating forms, finding files, and referring to previous records a more streamlined process, providing an obvious advantage over traditional methods.

- Your data remains secure. When you’re manually processing your payroll, chances are there will be a lot of paperwork involved. This paperwork needs to be organized, which is usually done by keeping documents in folders or binders. Unfortunately, anyone with access to the office can easily snag these forms, stealing valuable data such as employee social security numbers, income information, or contact information. Proper payroll software stores your payroll and HR information digitally, preventing any would-be thieves from stealing valuable employee information by storing it in the cloud. You should choose a company like UZIO that values cybersecurity because online data theft is unfortunately a common occurrence. You don’t want to make your business an easy target.

- Most payroll software doesn’t require a specialist. Manually calculating payroll requires employing dedicated payroll specialists, lest you risk an inaccurate payroll and possible fines. Hiring these types of workers can be quite costly, especially if you want a payroll expert with a great reputation. Fortunately, you can save yourself on the costs by using payroll software for small businesses. Not only is the price of these programs generally cheaper than hiring a specialist, but their ease-of-use means that your current staff won’t have a problem adapting to and starting to use them right away.

- Payroll solutions usually offer multiple options for distributing employee pay. This is especially helpful if you’ve previously only offered checks to your workers. These days, you might lose top-tier workers to competitors if you don’t offer direct deposits, so it’s essential to offer multiple payment options. This will keep your workers happy, and your employee retainment rate up. Options vary by payroll platform, but common payment methods include direct deposit, prepaid cards, and paper checks.

- Payroll reports can be produced by the software. Calculating annual reports can be a very intimidating process for HR and payroll staff. Having to review the past year’s documentation and generate a report with complete accuracy poses a huge obstacle for staff already overwhelmed by an abundance of other tasks. Thankfully, complete payroll solutions can solve this problem for you, as they automatically record and calculate your payroll information year-round. Instead of spending days manually reviewing data to create a report, you can create monthly (or even yearly) reports with just the click of the button!

- You’ll be able to save office space. Securely storing an entire company’s paperwork requires a lot of office space. File cabinets can quickly turn a large office room into a cramped space with little room to move. This claustrophobic setup can be extremely detrimental to the overall morale of staff. Thankfully, cloud-based payroll services don’t require any physical space, so your staff will quickly be able to regain their office space after you implement payroll software into your company.