Are you in a fix whether to process your payroll weekly, bi-weekly or semi-monthly? If that is so, then don’t worry we are about to shed some light on this. You will soon unearth the ideal modus operandi to process your payroll, and finally, get rid of the conflict that you have been pondering over.

Let’s face it, managing businesses is not a piece of cake, and gradually you realize that it is a vicious circle with numerous compliances and regulations to abide by. Apart from focusing on your business, you need to take care of a lot of other things that you may not have thought of yet.

Payroll processing and management is the problem child of regular business transactions that puts you in dire straits.

Let us make it simple by addressing first, how frequently you should pay your employees depending upon the size and nature of your business.

The payroll frequency trends in the United States:

Let us understand how other businesses have been processing their payroll when it comes to the frequency of payments.

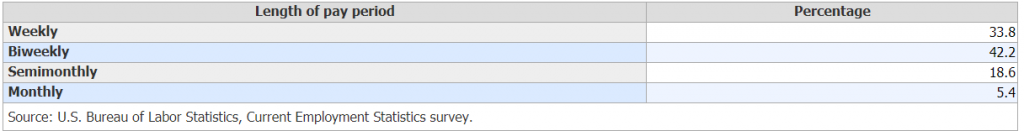

According to the U.S. Bureau of Labor Statistics bi weekly payroll processing is the most commonly practiced frequency with 42.2% followed by weekly at 33.8%. Semi monthly and monthly payroll frequencies are least practiced with 18.6% and 5.4% respectively.

Here is a small chart for your reference.

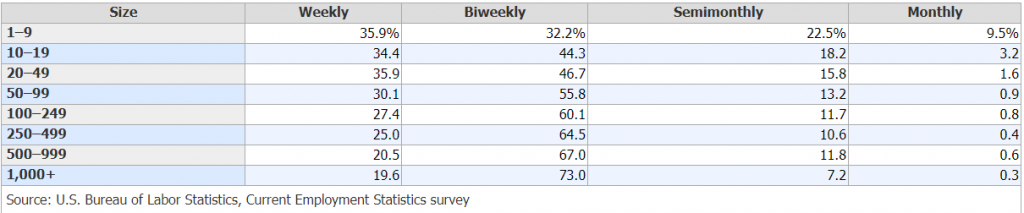

But, only because bi weekly payments are most popular this doesn’t mean you should make a decision right away, just going by the data. There are other factors involved too such as the size of the business and the industry you operate in. This data repositions with the number of employees for which a business is processing payroll.

Despite being the most popular choice of payroll frequency, bi weekly payments are preferred less by small employers as compared to large employers. Employee size of 1-9 has the least biweekly payroll frequency which gradually increases in coherence with the employee size.

Refer to the chart below to get more clarity on this.

Refer to the chart below to get more clarity on this.

Some payment frequencies seem to be more popular in certain industries; for example, the construction industry tends to use biweekly payroll with over 76% as per the survey conducted by the CES. Weekly & Semi monthly payroll seems to be more popular with small business sizes.

Understanding biweekly & bimonthly payroll

The companies that pay their employees bi weekly, will have three pay periods instead of two for two months in a year. This means that a total of 26 transactions will have to be made in case of biweekly payments and 24 transactions if chosen to pay semi monthly. The transactions are even higher when you tend to process your payments weekly.

What is the ideal frequency for you

Truth to be said, the ideal frequency is the one that your employee prefers. Employers should allow their employees to choose the frequency of their payments. Every worker has their personal needs, and one solution fits all may or may not work if you have over 50 plus employees. The more the number of employees, the more diverse the needs of the employees are.

Small employers may tend to avoid weekly or more frequent transactions because of the amount of work and calculations required in quick successions. If you are managing your payroll on spreadsheets you may not want to process your payroll frequently, but rather choose a monthly payments option. However, monthly payments are not very popular among the workers in the United States and may hamper your reputation as an ideal employer.

But more transactions mean more accrual costs for your accountant to process the payroll, and paying your vendors who might be charging on a per transaction basis.

UZIO has a fixed payroll transaction fee per employee per month that should save you from burning holes in your pockets. The pricing plan of UZIO has been created keeping in mind the different businesses, their needs, and the ability to adapt for employers of all sizes.

Automate your payroll

If you are still using spreadsheets to manage your payroll, then you might be losing a good chunk of your precious time that otherwise could have been utilized to grow your business.

Learn how you can automate your payroll with a few easy clicks, and give your employees the freedom and happiness they deserve.