Hundreds of businesses are benefitting from the UZIO’s world-class payroll software integrated with HR & benefits. Fill in your details to get started.

UZIO can handle all your state and federal taxes. UZIO files taxes on your behalf with the right government agencies every time you process the payroll.

Changes made in the employee salary will be reflected across the system automatically & update wherever required in real-time.

Deposit directly to your employees’ bank account. Set-up the process with easy clicks and voila it’s done automatically on every pay cycle with accurate figures.

Your employees get access to the self-managing portal where they can see their paystubs and download the same for their reference.

Benefit deductions are automatically reflected in the payroll with world-class integration and a centralized solution for benefits management.

Set-up multiple payroll periods as per your requirement. You will never have to worry about disbursing salary bi-monthly, monthly or weekly.

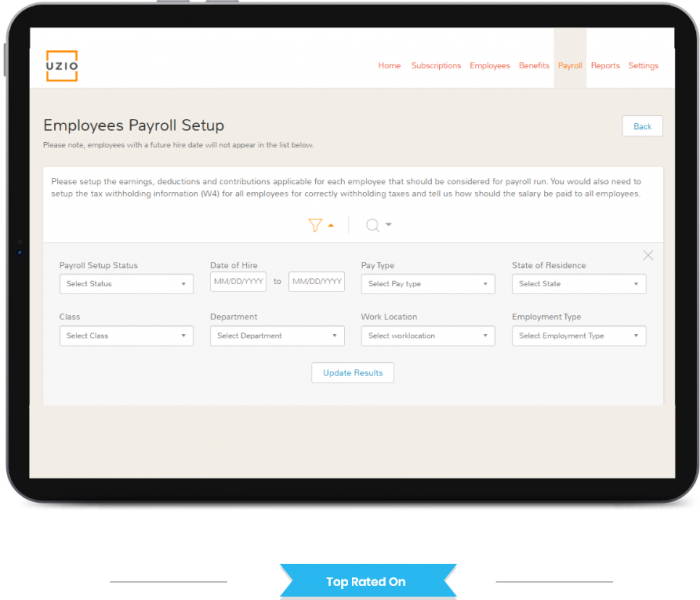

Add new employees or contractors, provide the necessary data such as working hours, salary, payment periods, etc. and you are all set.

Approve the payroll by giving it a final look with a single click. UZIO provides accurate data, and information is updated across the suite in sync with HR & benefits.

Deposit directly to your employees’ bank accounts, generate pay stubs, checks, and more. Keep it accurate and up-to-date.

UZIO replaces spreadsheets, paper forms and everything manual inside your payroll and HR functions. Manage workforce in a paperless environment.

No more clunky spreadsheets, lengthy email threads, or complex payroll calculations. Liberate yourself from mundane, error-prone manual tasks with our fully integrated payroll & HR platform.

Smarter processes and features within the platform make UZIO the perfect companion for all your payroll needs. Focus on what's more important for your business while UZIO takes care of the rest.

UZIO, Inc. © 2022. All Rights Reserved