Your business is growing and to manage this growth you need highly qualified employees. Considering the very tight job market and the desire for employees to work remotely, you decided to expand your employee search beyond your home state and started looking for remote employees in other parts of the country.

It makes perfect sense and really what could go wrong? Well, a lot if you do not take the necessary steps to remain in compliance with state registration, taxation, unemployment insurance and workers compensation insurance laws and regulations of other states.

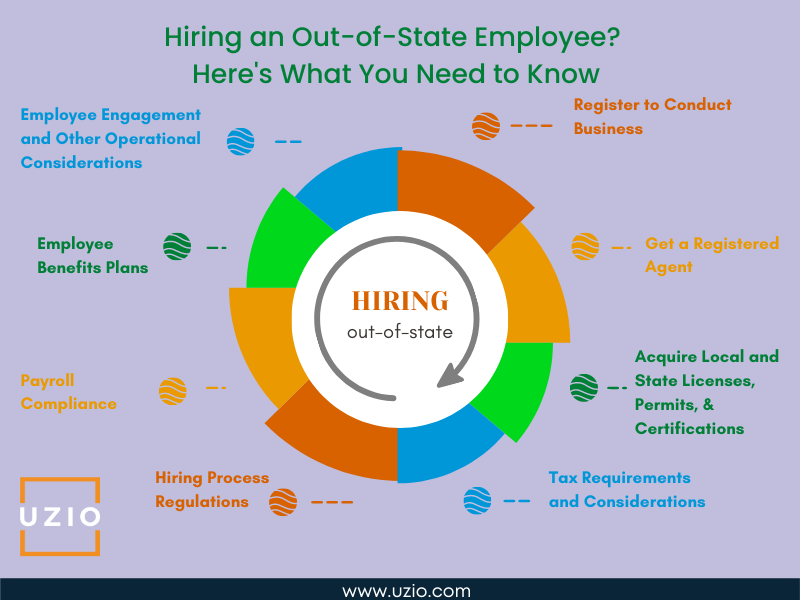

In this guide, we will give you step by step instructions so that you remain in compliance with different state laws and regulations and avoid paying big fines and penalties.

Let us get started.

Register to Conduct Business

If you are hiring employees outside of your home state, the first thing you need to do is to register to do business in that state. Each state has a slightly different process for this. SBA (Small Business Administration) has the information you need on how to register with federal and state agencies.

Get a Registered Agent

If your business is an LLC, corporation, partnership, or nonprofit corporation, you’ll need a registered agent in the state where you are hiring your employee.

A registered agent receives official papers and legal documents on behalf of your company. The registered agent must be located in the state where you register.

Many business owners prefer to use a registered agent service rather than take on this role themselves.

Now that you have taken care of registering with the state where you are hiring the new employee, the next step is to ensure that when you process payroll for this employee, you can withhold applicable taxes on behalf of the employee and also pay unemployment insurance tax in that state.

If your payroll system either does not support out of state tax withholding or is not sophisticated enough to prompt you to get applicable SIT (State Income Tax withholding account) and SUTA (State Unemployment Tax account) details, you may unknowingly be in violation of that state laws and may incur penalties and fines. We have seen this with a number of employers who came to Uzio because their previous payroll provider did not have comprehensive support for out of state hires and the employer ended up with big fines.

Here are some tips on For a Massage Franchise owner: How to correctly calculate wages for your massage therapist? – UZIO Inc, so that you can stay focused on running your business and still comply with the FLSA.

State Income Tax Withholding Account

Most but not all states have state income tax and they require employers to withhold state income tax from employees wages who are working in that state. You should get a state tax id number so that you can withhold taxes. You can find more information about how to procure a state tax id here.

State Unemployment Tax (SUTA) or State Unemployment Insurance (SUI)

In addition to withholding state income tax on behalf of employees, the employers are also required to pay state unemployment tax. You will see SUTA and SUI terms being used interchangeably. Every state has a slightly different process for registering for SUTA/SUI.

Once you register, you will receive an account number and a tax rate. You want to make sure that your payroll solution is updated with the account number and corresponding rate so that unemployment taxes are withheld and deposited with the right agency.

Worker’s Compensation Insurance

When you hire an out-of-state employee, you want to make sure you purchase Workers compensation Insurance for that employee in that state. ‘Workers comp’ as it is usually called provides coverage to employees when they are injured in an accident at work.

The coverage provides for medical care as well as compensation for a portion of the income employees lose when they can not return to work because of the injury. Many states require employers to submit proof of the coverage and if the proof is not provided in time, the employer can be fined hundreds or even thousands of dollars.

So it is critical that you have workers compensation insurance coverage for your employees in the state they are working. If you are working with a payroll provider like Uzio, we make sure that you have workers comp coverage for all your employees. If your payroll provider does not provide you this service, you can also work with a broker to purchase the required coverage.

Payroll

The federal government sets a minimum wage of $7.25 per hour, and many states have higher requirements. If you’re hiring out-of-state employees, keep in mind that overtime rates are typically time and a half of your normal pay rate for any hours worked over 40 hours in a single week.

Additionally, each state has its own rules regarding pay frequency and pay stub requirements; it is important to comply with these rules if you want to avoid expensive fines and penalties.

For example, California requires employers to provide pay stubs on or before payday—and pay stubs must include all information required by law (e.g., deductions). Failure to do so can result in a fine of up to $100 per employee for each violation.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Summary

Hiring remote workers in the very tight job market seems like a no-brainer however as an employer you want to make sure you follow the steps outlined above to remain compliant with the state laws and avoid costly fines. It may seem daunting at first however if you work with a payroll provider like Uzio, we take care of all the steps outlined above. If you are looking to hire out-of-state employees, you should first give Uzio a call.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.