Many companies who start out using a PEO (Professional Employer Organization) for their HR, Payroll, Benefits needs, sooner or later decide to transition out of the PEO and bring their HR functions inhouse. The companies make this decision because of a number of reasons like:

- High Monthly Fees charged by the PEO

- Poor Employee Experience

- Limited choice of medical benefits

For a detailed guide on How to Transition out of a PEO, please refer to our earlier blog post on this topic.

Recommended Reading: How to transition out of a PEO and bring your HR, payroll and benefits in-house?

Once you made the decision to leave your PEO, you are now wondering what are the tax implications if you do this transition mid-year. This article will provide information that can help you make that decision confidently.

Let us start by stating the obvious which is that it is always better to transition out of the PEO relationship at the end of the year. The main reason is that all the federal and state taxes for the employer as well as employees get reset at the start of a new year. When it comes to taxes, there is no negative impact on the employer or the employee of the transition if it is done at the end of the year.

However let us assume that you can not wait till the end of the year for the transition. Here is a list of tax related items you should consider before you make that decision.

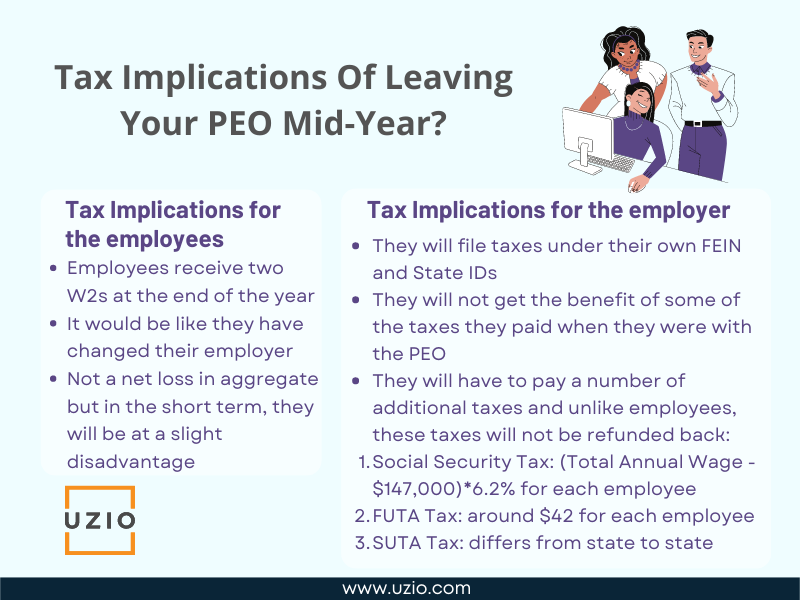

Tax Implications for the employees

Having come out of the PEO, you will be filing the federal and state tax returns under your own FEIN and state IDs. For your employees, it would be like they have changed their employer even though they continue to work for you. Information of the social security taxes already paid by the PEO for an employee, will not come over.

For example, let us assume that an employee had already met the wage base for social security tax which is $147,000 in 2022 and so the PEO was not withholding the Social Security tax from the employee anymore for the year. Once the employer comes out of the PEO, the Social Security Tax will be withheld for the employee for the remainder of the year until the wage base is met again.

The employee will receive two W2s at the end of the year. When the employee files the taxes next year, the extra Social Security Tax withheld will be refunded to the employee. So while it is not a net loss to the employee in aggregate, in the short term, the employee will be at a slight disadvantage.

Tax Implications for the employer

After the employer exits the PEO, the employer will file taxes under their own FEIN and State IDs meaning they will not get the benefit of some of the taxes they paid when they were with the PEO. They will have to pay a number of additional taxes and unlike employees, these taxes will not be refunded back.

Social Security Tax:

For each employee, the employer portion of the social security tax will have to be paid. This will not be refunded back to the employer. Rough calculation of the extra Social Security Tax paid by the employer for each employee would be something like:

(Total Annual Wage – $147,000)*6.2%

When this is added for each employee, it can be a significant amount.

FUTA Tax:

FUTA is Federal Unemployment Tax which is effectively 6% on each employee’s eligible wage upto $7,000. However you receive a tax credit of 5.4% if you pay all your state unemployment tax.

Rough calculation of the FUTA paid by the employer for each employee would be around $42, which is $7,000 times 0.006.

SUTA Tax:

SUTA is State Unemployment Tax which is assessed by the state on the employer. Unlike FUTA, it differs from state to state.

Rough calculation of the SUTA paid by the employer for each employee would be SUTA rate times wage base. For example if the SUTA rate is 2.7% and the wage base is $9,000, the SUTA tax would be $243.

There may be some other minor additional taxes withheld for the employer and the employee based on where the employee lives.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Closing thoughts

From the tax perspective, the ideal time to leave the PEO is at the end of the year. However if you have to leave the PEO mid-year, please use this guide to calculate the additional tax liabilities. Even though, as an employer you will be paying extra taxes as outlined in the article above, it might still be worth leaving the PEO if your employees are unsatisfied with the service or you are paying too much in the PEO fees.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.