Are your workers employees or independent Contractors? Are you in compliance with laws like California AB5?

Quick links

-

Introduction

-

Independent contractors Vs Company employee

-

Requirement for Legislation

-

California AB5 law introduced

-

What is California AB5 law?

-

Implications of AB5 and the road ahead

Introduction

Businesses often bring in independent contractors instead of hiring full time employees. There are many reasons for it. Economic uncertainty, lack of visibility into sustained customer demand or temporary surge in customer demand typically causes the business owners to bring in an independent contractor instead of hiring a full time employee. The contractors do the same job which is done by the employees but they are not on the payroll, they are not offered benefits, they do not have the same protections as employees of the company.

Independent contractors Vs Company employee

Should independent contractors (ICs) be treated as employees, has been a topic of debate for far too long between corporations and workers rights groups. Because independent contractors do not have the same protections and rights as those of employees, many times the total cost of an independent contractor is less than the total cost of hiring an employee. Corporations find this as an added advantage of working with independent contractors. Workers rights groups consider this as an exploitation of contractors and have been pushing for contractors to be treated as employees.

This dispute has taken a whole new meaning in the gig economy. In recent years, millions of people have been working as independent contractors for App based companies like Uber, Lyft, DoorDash etc. Additionally, many other companies have sprung up who bring demand (customers) and supply (contractors providing services like tutoring, massages, nannies, chefs) together. Almost all of these companies engage with contractors to fulfill the demands of their customers.

Requirement for Legislation

Looking at this growing trend, legislatures in different states are taking notice. Concerned that contractors might be getting exploited by these companies, they are coming up with legislation to codify who is an employee and who is a contractor.

As almost always happens in cases like this, California has taken the lead in passing the legislation to address the issue of who is an employee and who is a contractor.

California AB5 law introduced

A law called AB5 took effect in California on January 1, 2020 that dramatically changed the rules employers must use to determine whether workers are employees or independent contractors (“ICs”) in the state.

The law applies only to workers in California—regardless of where the employer is based. It does not apply to workers outside of California even if the employer is based in California.

As a result of AB5, many California workers who had previously been classified as ICs must be reclassified as employees and are entitled to employee benefits and protections. This led to an uproar in the business community.

Uber, Lyft and other online hiring platforms sponsored a successful ballot proposition (Proposition 22) which exempted most drivers of App-based ride share and delivery platforms from the law. Plus the law was also amended to add more exemptions.

What is California AB5 law?

The rules discussed below apply to all California workers who are not exempt from AB5.

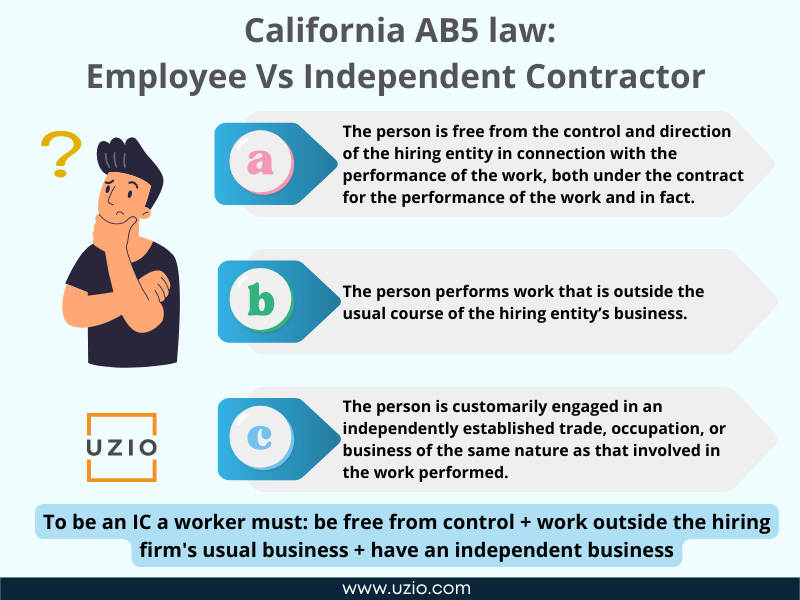

According to the law, for CA workers who are not exempt from the law, a test called “ABC Test” must be applied to classify Nonexempt workers.

Under this test, a worker is an IC only if he or she:

(A) is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact, and

(B) performs work that is outside the usual course of the hiring entity’s business, and

(C) is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

All three prongs of the ABC test must be satisfied for workers to be independent contractors. In other words, to be an IC a worker must: be free from control + work outside the hiring firm’s usual business + have an independent business.

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Implications of AB5 and the road ahead

It’s difficult for most workers to qualify as independent contractors under the ABC test. If your business is based in California and you have been using ICs, you should start planning for converting them into employees if they do not pass the ABC test.

As a payroll company that serves SMBs in all 50 states, we are seeing a trend where an increasing number of businesses in California who were initially using ICs are now converting them into employees. We are also tracking similar legislation underway in a number of other states, meaning even if you operate in other states, you may face this issue sooner than later.