When you run your own business, it’s not enough to just know the ins and outs of your industry or have great vision for the future of your company.

You also need to have an in-depth understanding of all the nitty-gritty details, including payroll.

Payroll isn’t something that most small business owners spend much time thinking about, but it can turn into a complex nightmare if you don’t handle it right.

While there are no hard and fast rules when it comes to managing payroll, there are plenty of best practices that can help you run payroll smoothly.

For e.g. quick direct deposit is a must for any good payroll software. According to the “Getting Paid In America” survey 2021, 95.88% of respondents receive their pay through direct deposit. Which was 93.87% (2% less) in the 2020 survey.

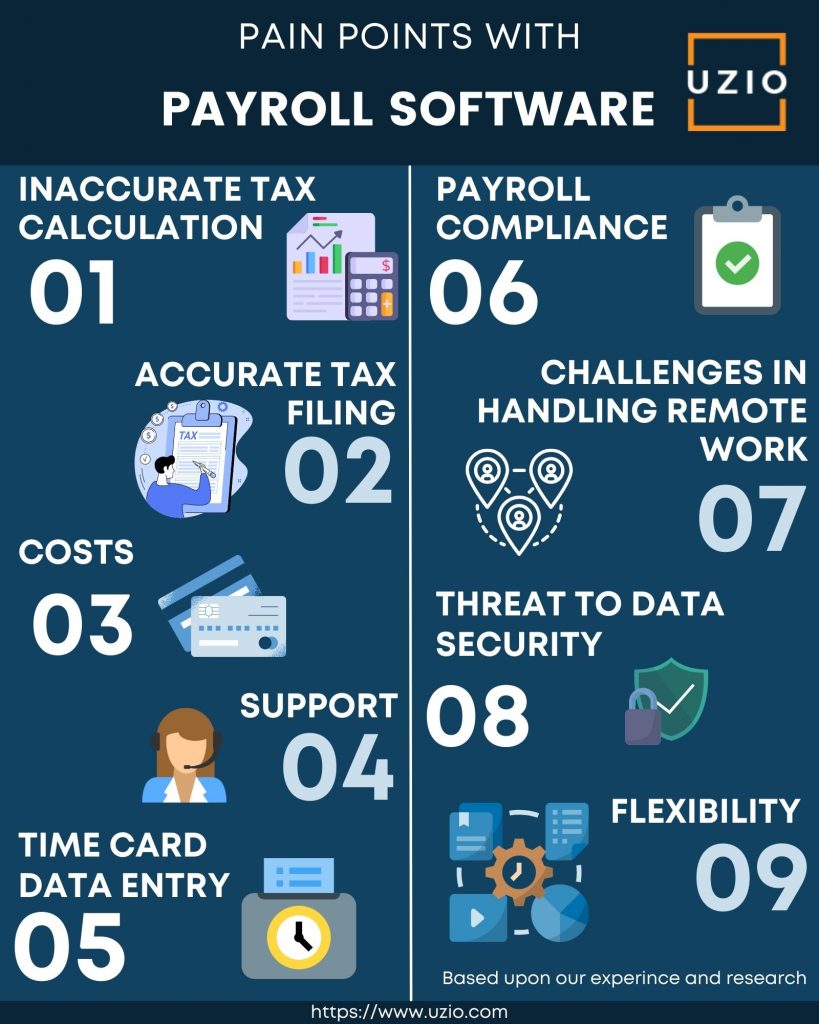

In this article we are going to cover all the major issues a small business encounters with their payroll software/company and how to deal with them.

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

So coming back to the topic, here are key issues w.r.t your Payroll software:

1) Inaccurate Tax Calculation

The biggest pain point faced by businesses from their Payroll software is inaccurate calculation and filing of taxes. Ensuring that all tax obligations are met is no easy task because of the complexity and the ongoing changes in the state and federal income taxes laws.

The problem is compounded by the inability of the payroll software vendors to make timely changes in their software to account for the changes in the tax laws and regulations.

It is not uncommon for local jurisdictions in a state to add/modify their tax laws. There are thousands of such jurisdictions. Tracking tax law changes across these jurisdictions can be very complex and costly.

Many payroll software vendors are not able to keep pace with all these changes. That is why employers should be careful when they select their payroll vendor and make sure their vendor has a proven track record of accurate tax calculations across all 50 states.

If you are facing issues with your tax calculations, our team can help. Please use the link above to schedule a demo of our payroll software.

2) Accurate Tax Filing

Even if your payroll software is calculating taxes correctly, there can be issues with tax payments to state and federal agencies. The roots of these kinds of problems can be traced back to the lack of tested and proven client onboarding procedures used by your Payroll software vendor.

When you are switching payroll vendors or starting fresh with a new payroll system, your vendor will ask you to collect and transfer tons of information about your business.

For example, you will share what is your Federal Tax Deposit Schedule.

Is it monthly or semiweekly etc.? If this information is not accurately captured by your Payroll vendor, it may lead to missed tax payments to the IRS and may result in hefty penalties.

It is very important that your Payroll vendor has proven and tested procedures in place to accurately transfer key information about your business into their Payroll software.

If you are facing issues with your tax filings, our team can help.

3) Costs

The costs of running a payroll for a small company can quickly add up. The pricing method used by Payroll vendors varies widely. There are some vendors who use a flat fee per employee per month often referred to as PEPM plus a small base fee.

In this model, the customer is not nickeled and dimed for every other task.

There are other vendors who would offer you attractive prices to lure you away but there are tons of hidden costs and the total cost of running the payroll is enormous for the customer.

For example, these vendors will charge extra when you run multiple payroll in a month or when you ask to make changes to the prior payroll data or if you ask to print the checks etc.

When you are evaluating payroll vendors, make sure you are comparing apples to apples by taking into account all the costs and not just what is advertised upfront by the vendor. Running Payroll for your business will not be very expensive if you have done the due diligence upfront.

Learn more about UZIO Payroll Software pricing and other details.

4) Support

Not being able to get timely and accurate answers to your questions, when you are under a deadline to approve Payroll is one of the biggest pain points faced by businesses.

More often than not, there is a scramble to approve the payroll so that your employees get paid on time and many times, at the last minute, you run into an issue.

For example, one of your employees informed you that she has moved to a new state or she had a baby and she changed her medical benefit plan or her banking information has changed.

You urgently reach out to your Payroll vendor where you are on hold for hours.

When someone does come on line to answer your question, they have no knowledge of your business and you end up educating them for hours before you can get any answers.

If you have been in situations like this, you are not alone!

We hear these stories time and again from customers who have switched to Uzio’s Cloud Based Payroll Management System for their payroll because they did not receive proper and timely support from their vendor.

5) Time Card Data Entry

If you employ hourly employees, before you can process their payroll, you have to enter their hours worked into your payroll system.

If you use a time card entry system, the chances are that it is not the same as your payroll system.

This means you have to manually enter the data generated from your time card system into your payroll system. This is very time consuming and very error prone.

You should look for a payroll system that also has the time card data entry system, like we do at Uzio.

In Uzio, the time card data flows seamlessly into the payroll system so you save tons of time and have less errors running your payroll.

6) Payroll Compliance

Employers are responsible for paying all their employees properly, on time, and accurately. No exceptions.

That means withholding income taxes, matching FICA contributions, paying unemployment insurance taxes (if applicable), keeping accurate records of wages paid, hours worked, etc.

If you think about it, it’s an amazing amount of responsibility to put on someone running a small company without lots of resources or time.

That’s why there are payroll services that can take some or all of these responsibilities off your plate—so you can concentrate on what really matters: your product or service.

However, if you aren’t sure whether these services are right for you—or just want to learn more about how they work—you can contact us and we can share our expertise in the field to answer your questions.

7) Challenges in Handling Remote Work

Working remotely is an increasingly common reality for many employees these days. In fact, nearly 4 in 10 American workers currently do at least some of their work from home or via a mobile device.

And while that’s certainly good news for employers who want access to top talent, it presents new challenges in managing payroll.

Furthermore, during the pandemic, the typical onboarding and offboarding process, which involves many documentation and face-to-face meetings, was no longer feasible.

In such circumstances, a system that can automate remote attendance, leave requests, training, and other HR and payroll operations is more important than ever.

8) Threat To Data Security

Small-business owners may not have time for payroll administration, but that doesn’t mean they are not exposed to potential data breaches.

Companies with fewer than 50 employees are more likely to be hit by a data breach than companies with more than 1,000 employees.

These businesses are also much less likely to report data loss incidents—meaning it might take longer for issues like identity theft or fraud charges to show up on their accounts.

From simple things like support for “Two-Way Authentication” to more complex things like being SOC 1, SOC 2 compliant, your vendor should be able to convince you that your data is secure with them.

At Uzio, we have made data security our top priority. (Here are the details)

9) Flexibility

Payroll is one of those areas where we’d love for there to be a one-size-fits-all solution, but unfortunately, there isn’t.

Each company and employee is different, which means that every payroll system should be too.

If you’re planning on outsourcing your payroll function or switching providers at some point in your company’s life cycle (and many SMBs do), it’s important to find a provider that can adjust as needed.

More than likely you won’t want – or need – all of your options from day one; having a provider that can grow with you is key.

Challenges In Payroll Computation

With so many moving parts, it’s no wonder that even some of the smallest companies find payroll to be challenging. Making your processes better will pay dividends down the road; make sure you’re not overlooking these five common mistakes:

- Payroll errors aren’t always taken seriously as they can have a huge impact on a company’s bottom line

- The process of updating systems for each new employee is frustratingly tedious for all involved

- Keeping track of wages, taxes, employer contributions and more can be overwhelming at times

- When employees are unhappy with their salary structure, others may follow suit in an attempt to earn more

- There is always pressure when deadlines loom—but it’s important to keep things in perspective

Overcoming The Payroll Challenges in 2022 and going forward

Deloitte’s Payroll Operations Survey 2020 found that 61% of organizations currently use a cloud-based payroll solution, and the top three areas of improvement associated with their payroll software are compliance, accuracy, and self-service capabilities.

A lot of new small businesses often look for ways to save money wherever they can. Payroll software, however, is often one of those expenses that feels necessary in order to run a successful company.

The American Payroll Association 2018 report mentions that “49% of U.S. workers will leave a job after experiencing just two problems with their paychecks”. Additionally, organizations using software with both timekeeping and payroll capabilities were 44% more likely to have a low rate of payroll error.

But with so many options out there that seem too good to be true, it’s not always easy for companies—especially on a budget—to know which one is right for them.

Learn more about UZIO Payroll Software for Small Business or request for a free trial.