Payroll Company Implementing COVID-19 Supplemental Paid Sick Leave Law (SB 114)

Quick links

-

Introduction

-

SB 114 Implementation: Effective Date; Covered Employers

-

Who qualifies for SB 114?

-

What are the Employee’s Rights?

-

What are the Employer’s Rights?

-

Miscellaneous Rules

-

How to avail SB 114?

-

What Employers Need to Know About SB 114 and how it is going to affect them?

-

How Payroll Company Implement SB 114 in California

-

Notice Requirements

-

Conclusion

On February 9, 2022, Governor Gavin Newsom signed SB 114, effective February 19, 2022. The law requires covered employers to provide up to 80 hours of COVID-19 Supplemental Paid Sick Leave (“SPSL”) to covered employees who are unable to work or telework due to certain reasons related to COVID-19. with up to 40 of those hours available only when an employee or family member tests positive for COVID-19.

SB 114 is similar, but not identical, to California’s previous SPSL law, which expired in September 2021. The key provisions of SB 114 are summarized below.

SB 114 Implementation: Effective Date; Covered Employers

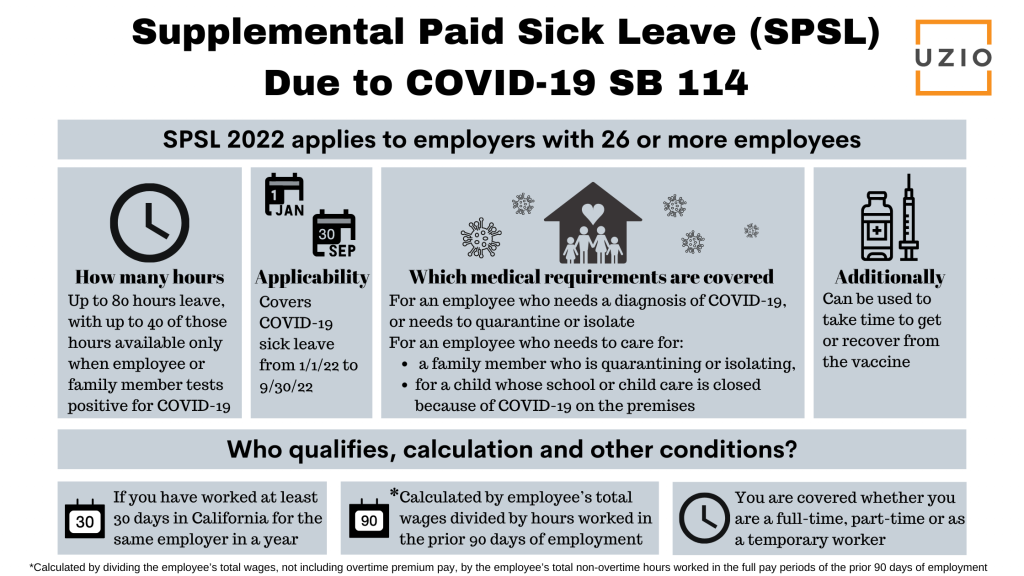

SB 114 became effective on February 19, 2022. However, employees can retroactively request SPSL to cover eligible absences going back to January 1, 2022.

- SB 114 applies to employers with 26 or more employees

- Covers COVID-19 sick leave from 1/1/2022 to 9/30/2022

- For an employee who needs a diagnosis of COVID-19, or needs to quarantine or isolate

For an employee who needs to care for:

- a family member who is quarantining or isolating, or

- for a child whose school or child care is closed because of COVID-19 on the premises

Can be used to take time to get or recover from the vaccines.

Who qualifies for SB 114?

You qualify for California’s permanent paid sick leave law if you worked:

- At least 30 days in California in a year

- After 90 days on the job

- Full-time, part-time or as a temporary worker

Most workers are entitled to permanent paid sick leave, earning one hour of paid leave for every 30 hours worked. The sick leave that employers are required to provide may be capped at 24 hours or three days per year.

Cities or regions in California may require employers to provide additional sick leave. For example, the City of Los Angeles requires a minimum of six paid sick leave days per year.

What are the Employee’s Rights?

- Employees can take up to 40 hours of COVID-19 supplemental paid sick leave but shall not exceed 80 hours for the period between January 1, 2022 and September 30, 2022.

- Test positive for COVID-19 more than 40 hours: Employees can take up to 40 more hours if tests come back positive for COVID-19. Employees do not have to use the first 40 hours to qualify for the extra 40 hours granted.

What are the Employer’s Rights?

- An employer may limit it to 3 days or 24 hours unless the employee provides verification from a health care provider.

- If that employee tests positive, Employer is authorized to require the employee to submit to another test on or after the fifth day, after the first positive test and provide documentation of those results.

- No obligation to provide additional COVID-19 supplemental paid sick leave if the employee refuses to provide documentation of a test result.

- An employer shall not be required to pay more than five hundred eleven dollars ($511) per day and five thousand one hundred ten dollars ($5,110) in the aggregate to a covered employee.

Miscellaneous Rules

- Employers cannot require employees to first exhaust their SPSL before satisfying any requirement to provide paid sick leave related to COVID-19 under any CAL-OSHA COVID-19 Emergency Temporary Standard.

- If an employee has already received paid time off for a COVID-19-qualified reason, since January 1, 2022 and before February 19, the employee is entitled to be credited back any paid time off, vacation time or other paid sick leave that the employee received. Similarly, if the employee did not receive paid sick leave for work time missed because of a qualified reason between January 1 and February 19, the employee will be entitled to receive such SPSL now.

- Unlike last year’s legislation, no provision allows for employers to apply for tax credits for SPSL payments made to employees.

How to avail SB 114?

Tell your employer as soon as possible that you will need to use your paid sick leave hours or ask about other leave benefits.

If you were not paid for the sick leave you took previously, you can still file a wage claim.

- Keep track of your hours and pay stubs

- Document communication with employer

- Contact the Labor Commissioner’s Office near you

SB 114 Supplemental Paid Sick Leave Request Fillable Form link is here.

What Employers Need to Know About SB 114 and how it is going to affect them?

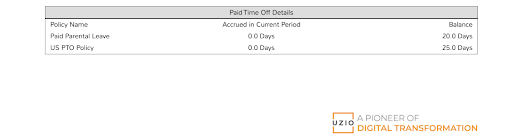

SPSL leaves taken must be reported as SPSL hours used on each pay stub. Beginning the next full pay period following February 19, 2022, SPSL and other sick leave used must be displayed separately on employee pay stubs, and retroactive payments must be displayed on pay stubs for the period during which payments are made. If no SPSL was used during the payroll period, then the pay stubs should display zero hours.

Employers should verify with their payroll departments, or with outside payroll vendors, that these new pay stub requirements are known and will be followed.

How Payroll Company Implement SB 114 in California

To make sure their customers in California are in compliance with SB 114, the payroll vendors need to change their systems. The most important change is related to the information that is displayed on the pay stubs.

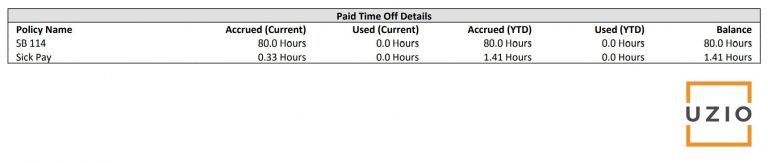

Normally the employee pay stub will show the time off “Accrued in Current Period” and the “Balance” as shown below.

Going forward, to accommodate for the requirements of SB 114, the pay stub should also display SPSL used. If no SPSL was used during the payroll period, then the pay stubs should display zero hours. Here is a sample of what PTO detail section of the pay stub should look like to be in compliance with SB 114:

Recommended Reading: Biggest pain point with Payroll and HR software

At any point in time if you feel like connecting with us in this respect, our team is there to help. You can use the link below to book a call with us.

Notice Requirements

Employers must post in a conspicuous location in the workplace, and disseminate by electronic means to employees who do not frequent the workplace, the new SPSL requirements and rights. The Department of Industrial Relations (Labor Commissioner) is required to make a model poster publicly available by February 16, 2022.

Conclusion

Employers in California are scrambling to be in compliance with SB 114. They are urging their payroll vendors to roll-out support for SB 114 at the earliest possible. Uzio has implemented the changes required to support SB 114 and rolled it out to its clients in California. If you are looking for a payroll vendor who understands SB 114 and whose systems are already in compliance with SB 114, you can reach out to us at using the link below.