Not sure what the W2 form is and why it’s important?

As with most things in life, understanding the why can make your life much easier in the long run, especially when it comes to taxes and tax season.

The W2 form (officially known as the Wage and Tax Statement) provides you with all of the information you need to prepare and file your state and federal income taxes on behalf of your employees.

This includes how much you paid your employees, the number of hours they worked, and payroll deductions that were withheld throughout the year such as Social Security, Medicare, and federal and state income taxes.

What is a W2 Form? How to make your own form W2?

It is an annual summary of your total wages from your employer.

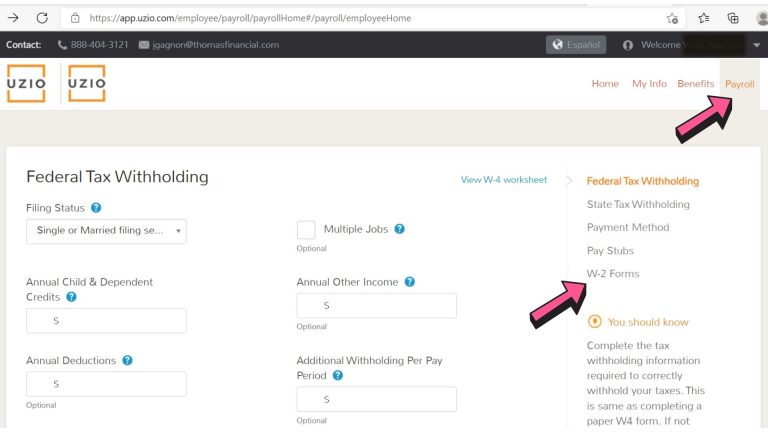

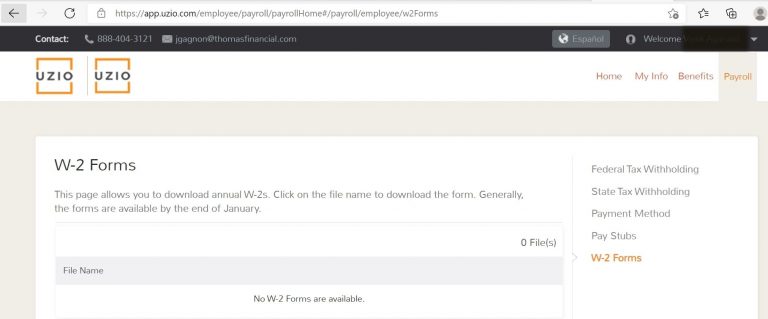

Employees can find Form W-2 in January in their mailbox, or by logging into their online portal if their employer is using any payroll solution with a self-service platform.

When do business send out w2?

January 31st is the deadline to distribute Forms W-2 to employee(s).

In addition to showing total wages earned during a calendar year, Form W-2 includes information about taxes withheld from each paycheck.

These numbers are used to file taxes with both federal and state governments. Employers use Form W-2 as proof that income taxes have been paid on behalf of their employees.

As such, they send out copies of Forms W-2 to employees at year’s end as well as file copies with states and federal agencies that require them regularly throughout the year.

Why is the W2 form important for small business owners? What is a W2 form used for?

Businesses use W-2s to file taxes for their employees, but what you may not know is that if you’re a small business owner without any employees, you still have to get a copy of your employee’s completed W-2 forms to file your own taxes.

Why does having a completed W-2 on hand mean so much when it comes to filing taxes?

Let’s dig into some reasons behind what makes these forms so essential to your financial status as an employer or self-employed person.

For instance, if you are a one-person shop working from home, then every single cent you make—after deducting expenses for things like mortgage payments and utilities—must be reported by using your 1040 return (the main tax form) in addition to filling out separate Schedule C (for sole proprietors) tax forms detailing how much money you made in total during that year.

If you didn’t include information on all of your income sources, then your overall profit would be lower than expected which could lead to serious consequences if you don’t pay appropriate state and federal taxes.

Also keep in mind that according to Section 3108(b)(8) of Title 26, U.S. Code, businesses must withhold social security and Medicare taxes for anyone they employ unless they receive a proper W-4 form for each worker after he or she has begun employment with them. One more thing: As we just mentioned above, you need copies of all four copies of Form W-2 – that were given to your employees at year-end to complete your income tax returns properly.

Can I File My Taxes Without a W2 Form?

If you’re self-employed, you need to file your taxes without a W2 form if your tax situation doesn’t qualify for one. If you were paid by cash, check, invoice, or credit card—but not through payroll—you’ll probably need to file as self-employed.

There are exceptions, of course; if you worked only part of the year or had multiple employers during a year, filing for an exemption might be in order.

Whether you do end up needing to file without a W2 depends on what box(es) on page 1 of IRS Form 1040 are checked off. The most common scenario in which people will need to file without a W2 involves sole proprietorships.

What if your employee loses the W2 form?

Fortunately, you don’t need to wait until tax time.

Your employee can file taxes without their W-2 by using an IRS Form 4852 which is a substitute for the form W2. You can also find two free e-files of Form 4852 on the IRS website that are available year-round. This way, if your employee loses their W-2, they can quickly file Form 4852 online instead of waiting until after tax season starts to receive a replacement from their employer.

However, as an employer, it is your responsibility to provide or reissue the W2 form to your employee in case he/she has lost it.

You are allowed to charge a very nominal cost for this service.

Employers can call the IRS directly at 800-829-1040.

You are supposed to have the following information with you before you contact the IRS:

- Employee’s name, current address, social security number, and phone number;

- Your company’s name, registered address, and phone number;

- The exact date since your employee has been working with you;

- The total wage you paid to your employee and federal income tax withheld this current year.

Consequences of filing an erroneous W2 form

The consequences of filing an erroneous W-2 can be severe.

Small businesses will be fined $50 per incorrect form filed, and employees who file an incorrect W-2 may face tax fraud charges.

If the mistake is minor then it may not face any penalties. But more importantly, these mistakes can hurt relationships with key employees and create distrust between employers and their staff.

If you think you’ve made a mistake on your W-2, talk to your payroll service provider about how to correct it as soon as possible.

It is advised to send a copy of W2 to your employees a month before filing your annual taxes.

How to stay error-free while filing your taxes?

UZIO can help you stay error-free with their full-service payroll platform where you as an employer will have full transparency. As an employer, you are in full control while UZIO does all the heavy lifting for you.

Automate the entire payroll process with full accuracy ensuring you don’t miss out on even a single item while filing your taxes or processing your payroll.

Do business owners get w2? W2 for self employed.

If you are operating your business under your own name, then technically, you are an independent contractor and not an employee. As an independent contractor, you won’t be entitled to a W-2.

You also do not issue yourself a W-2 if you are the owner of a business filing a Schedule C as a Sole Proprietor.

How to get w2 from previous employer out of business?

If your last place of employment has closed, it may be difficult to obtain a copy of your W-2. If you are unable to contact your previous employer, you can notify the IRS, who will try to contact the business and, in the event they cannot reach them, provide you with Form 4582 for your tax return .

Get in touch with us for an expert-led demo to know more about UZIO payroll services.