What is Form 940 and What It Means to Small Business Owners?

Quick links

-

What is form 940?

-

Who Should File IRS Form 940?

-

When Should a Company File IRS Form 940?

-

How to file form 940 online?

-

What is the difference between form 940 and 941?

-

Can I automate the entire process?

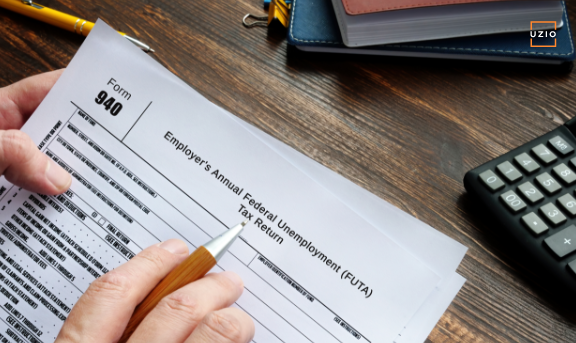

The Federal Unemployment Tax Act (FUTA) requires that businesses pay federal unemployment tax (FUTA) if they meet certain employee compensation thresholds and have $1,500 or more in employment taxes during any calendar quarter.

Form 940 (PDF), Federal Unemployment Tax Return, is the form employers use to report their FUTA tax liability to the IRS. The amount you owe depends on how many employees your business has and the wages you paid each calendar quarter.

FUTA tax contributions come out of your taxable payroll, so they lower your net take-home pay every pay period.

What is form 940?

This form is used by employers to pay Social Security and Medicare taxes.

Both employers and employees must pay these taxes, although there are different rates for each group. Typically, an employer pays 6.2 percent of employee wages into Social Security, while paying 1.45 percent of employee wages into Medicare.

Employees also pay 6.2 percent in Social Security taxes, but they do not pay any money into Medicare.

Employers do report Social Security and Medicare taxes withheld from workers’ paychecks on form W-2; workers who earn more than $200,000 per year ($250,000 if married) must report their income separately on schedule SE.

Recommended reading: What is a W2 form and why is it important for small business owners?

The IRS provides several worksheets that use information from both forms W-2 and SE to compute your total social security tax liability on form 940.

However, some businesses or individuals may need to fill out a special version of form 940 that reports self-employment earnings.

These taxpayers don’t typically have a payroll department or monthly withholdings from worker paychecks. In many cases, they must make quarterly estimated payments directly to the government instead of having withholdings paid for them.

Who Should File IRS Form 940?

Employers in most industries must file IRS Form 940 for each quarter of their tax year.

This includes individuals who operate sole proprietorships, partnerships, S corporations, or C corporations. The main exceptions are employers with 25 or fewer employees who pay $1,500 or less in wages in a calendar quarter.

If your small business meets both criteria—the employment count and wage threshold—then you do not have to file IRS Form 940 for that period.

This means if you only hire one employee to help out around your farm during harvest season, you don’t need to file IRS Form 940.

On the other hand, if you hire five workers on an ongoing basis for gardening work throughout spring, summer, and fall—even if they are considered part-time laborers—you still need to file IRS Form 940 until either of those conditions changes.

When Should a Company File IRS Form 940?

Many situations could lead a business owner to file IRS form 940.

However, if your company had no tax liability for 2020 or 2021, it won’t be necessary for you to file form 940.

If your business paid at least $1,500 in wages as mentioned above during either of those years, though, you’ll need to file form 940.

The only exception is if all of your employees are volunteers. In that case, you wouldn’t have been required to pay any federal payroll taxes on their behalf because they weren’t being compensated for their work.

In these circumstances, you don’t have to file a return. Instead, however, you must still provide each volunteer with a W-2 form at year-end.

You may also have to include an Employer Identification Number (EIN) box on W-2 forms filed with your state revenue department, but it varies by state.

The due date for filing Form 940 is January 31st but you get additional 10 calendar days if you deposit all of the FUTA tax when due.

How to file form 940 online?

The IRS allows taxpayers to e-file their tax returns by registering an account with E-File.gov.

Once your information has been verified, you will be able to file your taxes online. You can also request a copy of form 940 to mail-in by mail if you don’t have access to a computer or you can complete it using pen and paper.

Be sure to include all required information for each employee on the return when mailing it in. Make sure you are sending these forms through registered mail to ensure they arrive safely at their destination. If you are unable to find form 940 on any of these sites, call the IRS at 1-800-829-4933 for assistance with filing your employee taxes.

What is the difference between form 940 and 941?

The main difference between form 940 and form 941 has to do with employment taxes.

With form 941, you can pay your employees once a month; with form 940, you must wait until June 1st of each year.

So if you’re planning on keeping your employees on for multiple years, then go with form 941. If not, use form 940 because it simplifies tax payment options.

Note: even if you choose to use form 940, you still have to file information returns (such as forms W-2) by January 31st! Both forms cover Social Security and Medicare taxes, but form 940 includes income tax withholding.

Can I automate the entire process?

The good news for small business owners who need to submit quarterly tax payments is that, with today’s technology, you can automate your tax payments so you don’t have to worry about missing a deadline.

While it may be hard for some self-employed workers to track every 1099 they’ve received at year-end, payroll software such as UZIO will keep you on top of your forms and numbers.

Recommended reading: A Guide to Essential Payroll Forms & More for Small Business Owners

And we can help you pay those taxes quickly and easily, too. UZIO allows you to focus on your business and takes full control over how your payroll is processed and files taxes on your behalf without missing out on any due dates. UZIO allows employers to file their taxes online through their cloud-based payroll processing platform and deposit salaries in their employees’ bank account with just a few clicks.

Learn how UZIO is making life easier for small businesses.

Get an instructor-led demo with our payroll experts.