1. Introduction to Payroll/HR Systems for US SMBs

In the competitive landscape of small to medium-sized businesses (SMBs) in the United States, efficiency and compliance are not just goals—they are necessities for survival and growth. As an SMB owner or manager, you’re often tasked with making decisions that streamline operations without sacrificing quality or compliance. This is where a sophisticated payroll and human resources (HR) system can make a profound difference.

1. Why Consider a Payroll/HR System?

For many SMBs, payroll and HR tasks are time-consuming and fraught with the risk of errors. Whether it’s calculating overtime, managing benefits, or ensuring accurate tax deductions, these processes can quickly become overwhelming as your business grows. A robust payroll/HR system automates these tasks, reducing the likelihood of errors and freeing up your time so you can focus on core business activities.

2. Beyond Payroll Processing

Today’s payroll/HR systems offer much more than simple payroll processing. They integrate features such as HRIS (Human Resources Information System) and benefits management, creating a seamless ecosystem for managing your workforce effectively. These systems provide critical data that helps you make informed decisions about hiring, workforce costs, and benefits offerings. Additionally, they ensure that you stay compliant with ever-changing employment laws and tax obligations specific to your business location and industry.

3. The Right Tool for Every Size

It’s a common myth that only large corporations can benefit from or afford such systems. On the contrary, there are scalable solutions specifically designed for the needs and budgets of SMBs. These solutions not only accommodate current business sizes but also grow with the company, adapting to increased complexity as your employee count and operational needs expand.

As you navigate the subsequent sections of this blog, we will explore the strategic advantages, compliance benefits, cost-effectiveness, and essential considerations when choosing a payroll/HR system. Our goal is to equip you with the knowledge to make an informed decision about how such a system can benefit your business, ensuring that your operations are as efficient and compliant as possible.

2. Strategic Advantages of Payroll/HR Systems

When small to medium-sized businesses consider upgrading their operational tools, the decision must be strategic and impactful. Implementing a comprehensive payroll/HR system is one such decision that can transform your business. Here are the key strategic advantages these systems offer to SMBs:

1. Enhanced Decision Making with Data Analytics

In today’s data-driven world, having access to accurate and timely information is crucial for making informed decisions. Payroll/HR systems are equipped with analytics tools that provide insights into various aspects of your business. From understanding labor costs and overtime trends to analyzing employee turnover rates, these insights help you make strategic decisions that can lead to cost savings and improved employee retention.

Automation Reduces Errors and Saves Time

Manual payroll and HR processes are susceptible to human error, which can be costly in terms of both time and money. Automated systems reduce these risks significantly by ensuring that calculations are accurate and compliance with tax and employment laws is maintained. This automation frees up valuable time for your HR and finance teams, allowing them to focus on more strategic tasks rather than getting bogged down by routine paperwork.

2. Streamlined Employee Management

Modern payroll/HR systems streamline many aspects of employee management, from recruitment to retirement. By centralizing employee data in one place, these systems make it easier to manage employee records, track career progression, and administer benefits. This centralization not only improves operational efficiency but also enhances the employee experience by ensuring that their interactions with HR are smooth and productive.

3. Proactive Compliance Management

Keeping up with the myriad of federal, state, and local regulations can be a daunting task for any business. Payroll/HR systems help manage this by automatically updating their platforms in accordance with the latest legal requirements. This proactive approach to compliance management protects your business from potential fines and legal issues, and it ensures that you’re always a step ahead in terms of regulatory adherence.

4. Facilitating Remote Work

The ability to support a remote workforce has become a necessity, not a luxury, in the modern business environment. Payroll/HR systems facilitate this by providing cloud-based access to all necessary tools and information. Employees can view their pay stubs, request time off, or update their personal information from anywhere, at any time, which is particularly beneficial in today’s increasingly flexible work environments.

By leveraging these strategic advantages, a payroll/HR system not only supports but actively enhances the operational capabilities of an SMB. In the next section, we will delve into how these systems help ensure compliance with employment laws, a critical concern for every business owner.

3. Compliance and Legal Implications

For small to medium-sized businesses, navigating the complex landscape of employment laws and tax regulations is not just challenging—it’s a critical requirement for operational legality and success. A robust payroll/HR system plays an essential role in simplifying this aspect of business management. Here’s how such systems can help:

1. Ensuring Accurate Tax Filings

Payroll systems automate the calculation and withholding of federal, state, and local taxes. This automation helps prevent common mistakes such as underpaying or overpaying taxes. More importantly, it ensures timely filings, helping SMBs avoid penalties associated with late or incorrect tax submissions. By keeping track of changing tax rates and regulations, payroll systems provide peace of mind that your business remains compliant.

2. Adhering to Employment Laws

The United States has a myriad of employment laws that vary by state and even by city. This includes regulations on minimum wage, overtime pay, and sick leave accruals, among others. A good payroll/HR system updates its features to reflect these changes, ensuring that your business always adheres to current laws. This not only protects your business from costly legal actions but also supports fair workplace practices.

Managing Employee Benefits and Leave Policies

Compliance isn’t only about adhering to tax laws and employment regulations; it also involves the correct management of employee benefits like health insurance and retirement plans. Payroll/HR systems help administer these programs according to governmental guidelines and reporting requirements. Additionally, these systems manage various types of employee leave—such as FMLA, parental leave, and personal time off—ensuring that your policies comply with relevant laws.

3. Audit Trails and Record Keeping

An often overlooked aspect of compliance is the need for thorough record-keeping. Payroll/HR systems create detailed audit trails and maintain records for the required periods stipulated by law. This is invaluable in the event of audits or disputes, providing clear, easily accessible data that can substantiate your business’s compliance efforts.

4. Reducing the Risk of Penalties and Fines

By automating compliance features, payroll/HR systems significantly reduce the risk of facing penalties and fines due to non-compliance. This protective measure not only saves money but also shields your business’s reputation, ensuring that you are seen as a trustworthy and reliable employer.

In summary, a comprehensive payroll/HR system not only simplifies the intricate process of compliance but also acts as a safeguard, protecting your business from potential legal complications. This peace of mind allows you to focus more on growing your business and less on the nuances of regulatory adherence.

4. Enhancing Employee Experience and Engagement

A positive employee experience is crucial for fostering a productive, motivated, and loyal workforce. Implementing a sophisticated payroll/HR system can significantly contribute to this goal by improving several key areas of the employee lifecycle. Here’s how these systems benefit employees directly:

1. Timely and Accurate Payroll Processing

One of the most tangible ways a payroll/HR system impacts employees is through reliable and accurate payroll processing. Ensuring that employees are paid correctly and on time is fundamental to maintaining trust and satisfaction. Automated systems eliminate common payroll errors and delays, which are often sources of employee frustration in manual processes.

2. Self-Service Portals Enhance Independence

Modern payroll/HR systems often include self-service portals that empower employees to manage their personal information, view their pay stubs, request time off, and access HR documents independently. This autonomy can significantly enhance employee satisfaction as it provides them with control over their personal data and reduces the time spent on administrative queries.

3. Better Access to Benefits and Company Policies

An integrated payroll/HR system simplifies the management of employee benefits, from health insurance to retirement plans. These systems allow employees to easily enroll in benefits, update their choices, and understand their entitlements. Clear, accessible information about benefits and company policies also ensures that employees feel well-informed and valued by their employer.

4. Support for Career Development

HR systems play a crucial role in career development by tracking performance reviews, training opportunities, and promotion paths. These features help employees understand their progress and career prospects within the company, directly contributing to their engagement and motivation.

5. Improving Work-Life Balance

By facilitating more efficient management of time-off requests and supporting flexible working arrangements, payroll/HR systems contribute to a better work-life balance for employees. Easy access to scheduling tools allows employees to plan and manage their time more effectively, which is especially important in today’s dynamic work environments.

5. Security and Data Protection in Payroll Systems

In an era where data breaches are not just disruptive but potentially devastating to a business’s reputation and finances, the security of payroll and HR data is paramount. Here’s how modern payroll/HR systems address these challenges to protect sensitive employee information:

1. Robust Data Security Measures

Advanced payroll/HR systems are equipped with state-of-the-art security features including end-to-end encryption, multi-factor authentication, and secure data centers that comply with stringent regulatory standards like HIPAA and GDPR. These measures ensure that sensitive data such as social security numbers, salary information, and personal employee details are protected against unauthorized access.

2. Regular Security Updates and Compliance

To guard against emerging threats, reputable payroll/HR system providers continuously update their security protocols and software. This ongoing commitment helps protect businesses from the latest cyber threats and ensures compliance with current data protection laws, which is crucial in maintaining trust and legal compliance.

3. Controlled Access and User Permissions

Payroll/HR systems allow businesses to set detailed user permissions, ensuring that employees can only access the data necessary for their roles. This minimizes the risk of internal data breaches and ensures that sensitive information is not accessible to unauthorized personnel within the organization.

4. Data Backup and Recovery Systems

In the event of a system failure or data loss incident, having robust backup and recovery systems in place is essential. Payroll/HR systems typically include automatic backups that store data securely in multiple locations, ensuring that it can be quickly restored and that business operations can continue with minimal disruption.

5. Educating Users on Security Best Practices

Beyond the technical measures, payroll/HR systems often provide training and resources to educate users on security best practices. This education helps prevent security breaches that occur due to human error, such as phishing attacks or insecure password practices.

6. Addressing Myths About Cloud Security

There is a common misconception that storing data in the cloud is less secure than on-premises solutions. However, cloud-based payroll/HR systems often offer enhanced security measures due to the scalability and technological prowess of cloud service providers. These providers are able to deploy extensive resources towards securing their infrastructure, which can exceed the capabilities of individual businesses, particularly SMBs.

In summary, investing in a payroll/HR system with robust security features is essential not only for protecting against external threats but also for ensuring internal data integrity and compliance. This level of security fosters trust among employees and safeguards the business from potential legal and financial repercussions.

Comparing Payroll Systems vs. Manual Processes for SMBs

| Feature | Payroll System | Manual Processes |

|---|---|---|

| Time Efficiency | High (Automated calculations save time) | Low (Time-consuming calculations) |

| Accuracy | High (Reduced human error) | Moderate (Prone to human error) |

| Cost Over Time | Lower (Efficiency reduces long-term costs) | Higher (Inefficiencies increase costs) |

| Scalability | Excellent (Easily adjusts to business growth) | Poor (Requires more resources as business grows) |

| Compliance | Automated updates ensure compliance | Risky (Requires constant manual updates) |

| Employee Access | Easy access via self-service portals | Limited or no access |

| Data Security | High (Advanced security measures) | Variable (Depends on in-house measures) |

| Reporting | Comprehensive and customizable reports | Basic and time-consuming to compile |

| Integration with Other Systems | High (Designed for integration) | Low (Often requires manual entry) |

| Support and Maintenance | Ongoing support and updates provided | Dependent on in-house expertise |

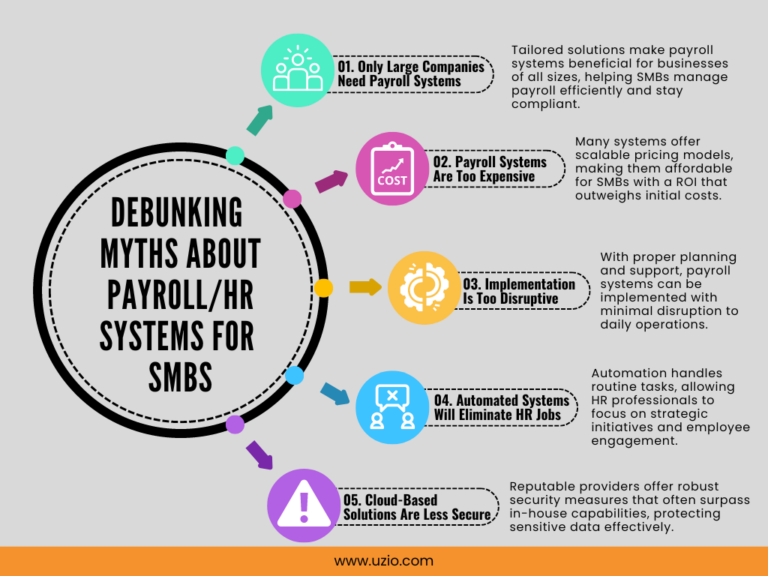

6. Debunking Common Myths

When it comes to payroll and HR systems, misinformation can lead to hesitation. It’s important to clear up these misconceptions so that SMBs can make informed decisions about implementing these systems. Here are some common myths and the truths behind them:

Myth 1: Payroll Systems Are Only for Large Corporations

Reality: This is one of the most prevalent misconceptions. While large corporations certainly benefit from the efficiencies of payroll systems, SMBs stand to gain just as much. These systems are scalable and can be tailored to the needs of smaller businesses, helping them manage compliance, payroll, and HR tasks more efficiently than manual processes.

Myth 2: They Are Too Expensive for Small Businesses

Reality: Many payroll/HR systems are designed with the budget constraints of SMBs in mind. Providers often offer various pricing models that scale with the size of the business and the features required. Moreover, the return on investment, including time savings, reduced errors, and compliance with legal standards, often outweighs the initial costs.

Myth 3: Implementation Is Too Complex and Disruptive

Reality: While implementation does require planning and adjustment, it doesn’t have to be disruptive. Many vendors provide comprehensive support throughout the process, including training, data migration assistance, and customer service, making the transition as smooth as possible. With proper planning and the right team, the switch can be managed effectively.

Myth 4: Automated Systems Will Eliminate HR Jobs

Reality: Rather than eliminating jobs, payroll/HR systems enhance the HR function by automating routine tasks. This allows HR professionals to focus on more strategic and impactful areas of their role, such as employee engagement, talent development, and strategic planning, ultimately making their roles more critical and strategic.

Myth 5: Cloud-Based Solutions Are Less Secure

Reality: This myth persists despite evidence to the contrary. Reputable cloud-based payroll/HR systems often offer superior security features compared to what SMBs can typically afford on their own. These systems leverage advanced encryption, rigorous compliance certifications, and regular security audits to ensure data is protected.

Recommended Reading: Biggest pain point with Payroll and HR software

7. Conclusion

Throughout this blog, we have explored the many ways in which a sophisticated payroll/HR system can transform a small to medium-sized business. From enhancing strategic decision-making and improving compliance to boosting employee satisfaction and safeguarding data, the benefits are clear and significant. These systems are not just administrative tools but strategic assets that can propel your business forward.

If you’re ready to take your business to the next level, consider UZIO—a leading provider of payroll, HRIS, and benefits solutions tailored for the unique needs of SMBs. UZIO is designed to simplify complex processes, ensure compliance, and enhance the overall employee experience, all while being cost-effective and scalable.

Moreover UZIO now integrates cutting-edge Artificial Intelligence (AI) and Machine Learning (ML) technologies to revolutionize HR, payroll, and benefits administration. The UZIO AI Copilot is here to transform your HR operations. This advanced AI-powered assistant can handle queries about Employee Information, Time Off Requests, and Payroll details with ease.

To know more about UZIO Payroll/HR solution and get in touch with us for an expert-led demo.