1. Introduction

Payroll is traditionally both one of the biggest operating costs and one of the heaviest administrative burdens, especially for companies that manage payroll manually. And for good reason—mistakes can result in both stiff IRS penalties and unhappy employees. As we find ourselves in the fourth quarter of the year, it’s a crucial time for small to mid-sized businesses to evaluate their payroll provider and consider making a switch if necessary. Payroll is a fundamental aspect of any business, and ensuring accuracy and efficiency in this process is paramount. In this article, we will explore why switching payroll providers now is the right move, how to identify the best fit for your business, and the steps to make a successful transition.

2. Why Consider Switching Payroll Providers in the Fourth Quarter

Your employees rely on timely and accurate paychecks, and your business depends on their satisfaction and productivity. When your current payroll provider isn’t meeting your needs, it’s time to consider a change. Here are some reasons why making the switch in the fourth quarter is advantageous:

- Avoid Historical Data Hassles: Switching at the end of the calendar year allows you to avoid the hassle of transferring historical payroll data. Switching payroll providers often involves transferring historical payroll data, employee information, and financial records. This process can be time-consuming and costly, especially if you have a large workforce. While exact cost savings will vary depending on the size of your business and the complexity of your data, switching in the fourth quarter can save money by reducing the need for extensive data migration.

- Streamlined Tax Processes: Changing providers mid-year can complicate tax payments and filings. Fourth-quarter switches can simplify tax processes, as you’ll start the new year with a clean slate in terms of tax reporting and filings. This can reduce the risk of errors and late filings, potentially leading to cost savings by avoiding penalties and fines.

- Employee Payment Consistency: Ensuring that employees are paid on time and without disruptions is critical for maintaining morale and productivity. Switching providers at a time that doesn’t interfere with regular payroll schedules can help avoid any issues related to late or incorrect payments. Consider the following factors:

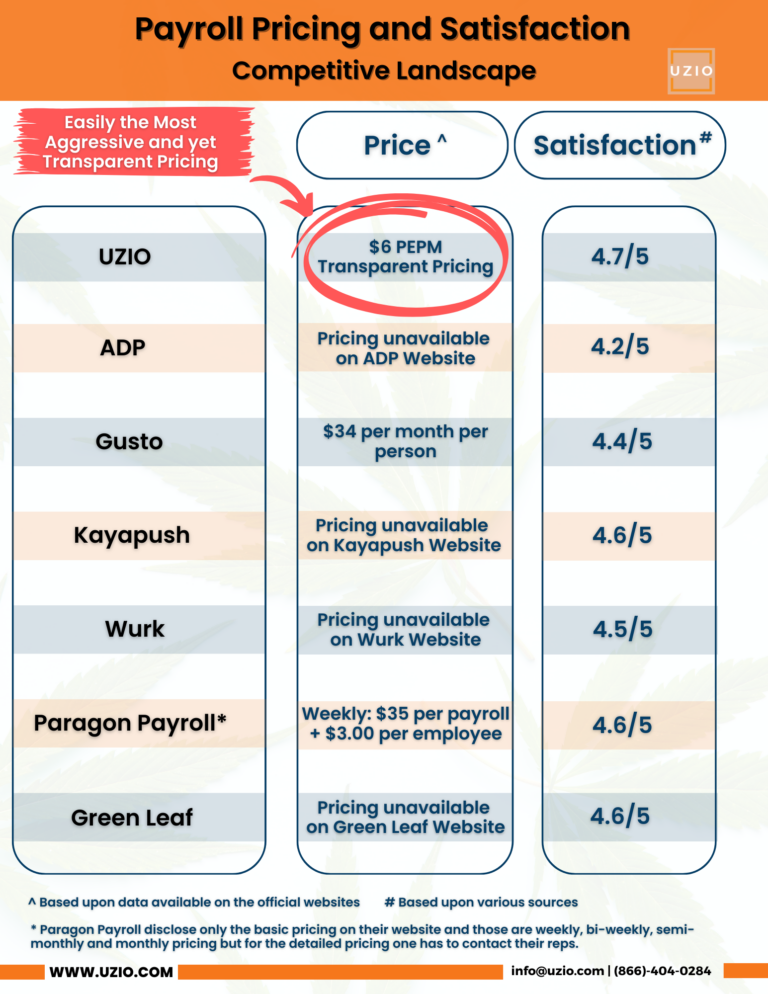

1. Cost: Evaluate if you are paying more than you should for your current provider.

2. Customer Service: Assess the reliability of your current provider’s customer service.

3. Ease of Use: Determine if your current provider’s software is user-friendly or causing unnecessary difficulties.

4. Customization: Ensure the provider offers services tailored to your specific business needs.

3. Switching Payroll Companies - A Checklist

Here’s a checklist to guide you through the process of switching payroll providers:

- Pick the Right Time: Consider switching at the end of the year (most recommended) or the beginning of a quarter for a smoother transition.

- Determine Needed Services: Identify the payroll services (payroll, HRIS, benefits administration, etc.) that are essential for your business. Questions to ask the potential vendor could include:

- What is the customer service experience typically like at your company? Which representatives would I speak with?

- Would my applications be compatible with your current software? What integration capabilities do you have?

- How would your organization handle the transition? What are typical timelines? What would my responsibilities be during the transition and afterward?

- How secure is your platform?

- What would happen if a payroll mistake is made?

- Check Current Contract: Review the terms of your current contract, including cancellation fees and notice requirements.

- Notify Current Provider: Communicate your plans to switch with your current payroll provider to facilitate a smooth transition.

- Choose a New Provider: Research potential payroll companies and ask for references from their customers.

- Gather Information: Collect necessary information from your company to provide to the new payroll provider. Information you will need include:

- Employee info

- Business info

- Payroll Registers and/or Quarterly Reports

- A voided check

- Proof of FEIN (Federal Employer Identification Number) from the IRS

- Payroll tax returns for the current year quarters

- Copies of payroll registers for each check date of the current quarter

- W-2 Forms

- Copies of a payroll quarterly report for each completed quarter for the current year

- Copies of quarterly tax returns for the current year

- Employee profile information including, name, address, social security number, tax withholding information (information found on the W4 form), rates of pay, recurring earnings/deductions, garnishment paperwork, and direct deposit information.

- Set Up Your Contract: Familiarize yourself with the new contract and understand your responsibilities and fees.

- Notify Employees: Inform your employees about the switch and guide them in the process for accessing their new pay information.

Recommended Reading: Affordable 401(k) Plans that Sync with Payroll and Benefits

4. Conclusion

Payroll is a critical aspect of your business, and a reliable provider is essential. If your current provider isn’t meeting your expectations, don’t hesitate to consider a switch. Doing so in the fourth quarter can save you time, effort, and potential disruptions, ensuring a smooth transition for both your business and your employees. Remember that choosing the right payroll provider is an investment in the success and satisfaction of your workforce.

Get in touch with us for an expert-led demo to know more about UZIO payroll services.